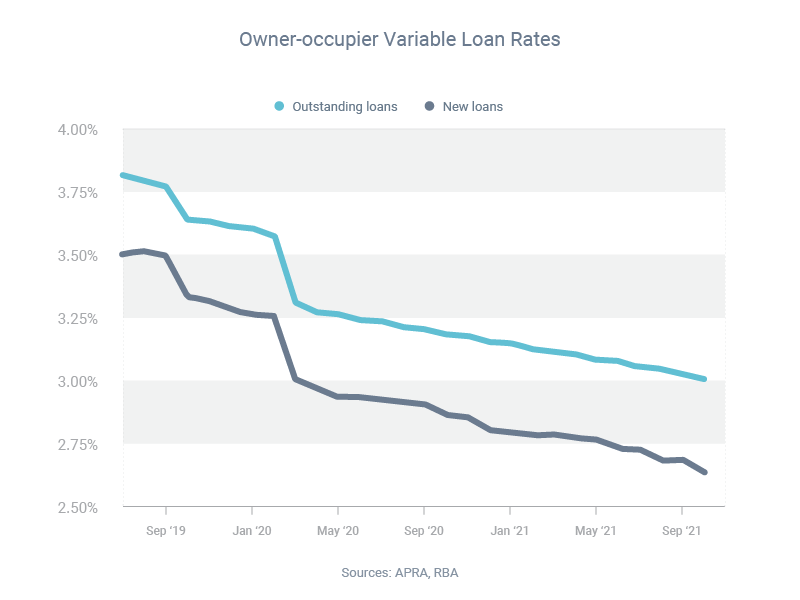

Are you paying a higher home loan interest rate than new borrowers? The Reserve Bank of Australia (RBA) has been tracking Owner Occupied loans for new and existing borrowers, and there is a gap, which has been widening. So how big is the gap?

In October 2020, owner occupiers who took out new variable loans were charged, on average, 0.32% less than existing borrowers and by October 2021, this gap had widened to 0.37%. For an existing borrower with a $500,000 home loan on the variable interest rate of 3% would pay an extra $35,444 over a 30-year loan term compared to a new borrower.

If, as many economists predict, the RBA increases the cash rate in 2022, it will be interesting to see if this interest rate gap narrows or widens, as lenders may seek to undercut their rivals to preserve or take a larger market share.

Want a better rate? Feel free to get in touch, we are here to help.